Please note that large taxpayers (liable during any calendar year for 5 million or more in excise taxes) must pay excise taxes by electronic funds transfer (EFT). You can file tax returns and payments electronically using Pay.gov (recommended).

#2016 tax extension business due dates archive#

Recent Years Firearms and Ammunition Tax Due Datesįor information about older due dates, visit our archive of Historical Due Dates. See the due date information below for your business situation.

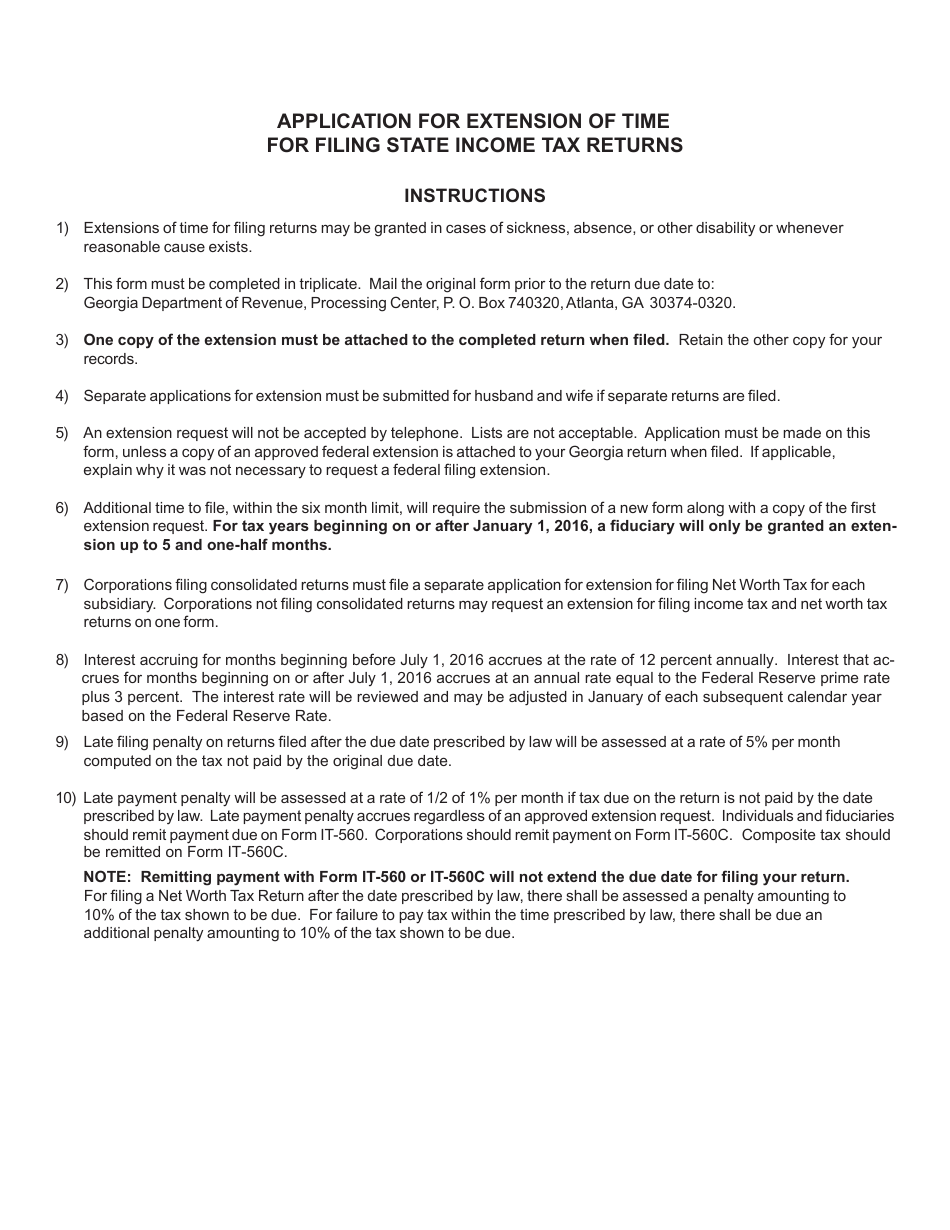

If you have any questions about these new due dates and the impact on your tax filings, please contact one of our qualified tax professionals at 703.385.8888. Recent Years Alcohol and Tobacco Tax Due Dates Filers of Form 990 (series) will now have an automatic 6 month extension period, ending on November 15th for calendar year filers, rather than a 3 month period. Previous Year (2021) Tax Returns and Reports Due Dates Current Year (2022) Tax Return and Report Due Datesįirearms and Ammunition Excise Tax Returns TIP: Visit our Automated Reminders for Filing Tax Returns and Operational Reports page and subscribe to receive reminders when it is time to file. Please note that large taxpayers (liable during any calendar year for $5 million or more in excise taxes) must pay excise taxes by electronic funds transfer (EFT). By the deadline for filing tax returns, taxpayers must be mailing their returns, addressing them and maintaining. It is almost impossible to fill out the 2016 tax return by July 15, 2020. In the event of a weekend or a holiday, the deadline remains April 15. If federal extension is accepted, the Department will grant an automatic extension to the last day of the 8 th month following the return due date. Helping business owners for over 15 years. An extension of time to file is not an extension of time to pay. You can file tax returns and payments electronically using Pay.gov (recommended). Extension of time to file can be granted by the Department for with a timely application and payment of tax due.

See the due date information below for your business situation. Use our Maintaining Compliance in a TTB-Regulated Industry Tool to help you determine your tax or reporting obligations. Don’t send the extension form separate from your Oregon return. The Oregon extended due date is the 15th day of the month following the federal extended due date. Corporation due dates arent affected by Emancipation Day. Your obligation as a taxpayer will depend on your circumstances and business type. If a due date falls on a weekend or state holiday, the return is due the next business day. Get Email Updates Tax Returns and Reports Due DatesĪs a TTB-regulated industry member, you may be responsible for paying federal excise taxes.

0 kommentar(er)

0 kommentar(er)